Which Is the Best Crypto to Buy Now? Bitcoin and Avalanche See Shifts to Digitap ($TAP)

The one constant in crypto markets is that even the biggest players can fall out of favor with an uncertain recovery timeline. For instance, Bitcoin (BTC) has lost at least 80% of its value on four separate occasions. Other crypto giants aren’t immune to selling pressure; a case in point is Avalanche (AVAX), which is down more than 50% this year.

Recently, on-chain observers have noticed a shift from these two crypto giants to a rising crypto presale project called Digitap ($TAP). Digitap is capturing a lot of attention as a potential crypto to buy now, as its “omni-bank” concept is quietly gaining market share among an overlooked market that spans more than one billion people.

Source: Digitap

Digitap’s Utility Strengthens Its Crypto To Buy Now Case

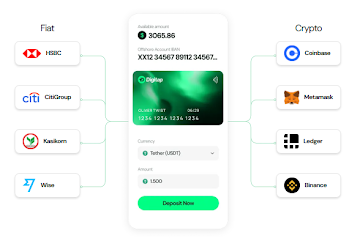

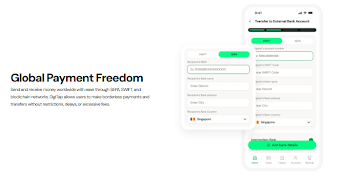

Digitap is the company behind the world’s first “omni-bank,” which merges the traditional financial world with cryptocurrencies. Digitap has developed a unified digital wallet and banking platform that allows users to hold both fiat money and cryptocurrencies. Users can move funds nearly instantly and spend any of their assets in real-world transactions with ease.

Digitap’s recent partnership with Visa introduced a prepaid Visa debit card to Digitap’s growing suite of products and services. Users can preload their Visa card with either fiat or crypto and spend their money anywhere Visa cards are normally accepted.

But perhaps the most compelling feature that makes Digitap one of the top altcoins to buy is its optional no-KYC signup process. This directly targets the approximately 1.4 billion underbanked or unbanked adults, many of whom live in countries without access to ID.

Providing basic and regulated bank features means these people can join the global economy. They can now benefit from a digital banking app that many people in Western countries take for granted.

Source: Digitap

Why Staged Rounds Hedge Volatility As Adoption Grows

Digitap’s presale event continues to attract whale investors, many of whom are former Bitcoin and Avalanche investors.

The presale is divided into phases where the native $TAP token is offered for sale at a set price. The price increases once each phase is sold out. Notably, the first round set the price of $TAP at $0.0125, and it is now offered at $0.0313. With an expected listing price of $0.14, investors can still buy the token at a roughly 80% discount.

Considering Digitap as one of the top altcoins to buy during times of market turbulence is a smart strategy. Digitap’s staged crypto presale offers investors a hedge against market weakness. Specifically, early participants are effectively guaranteed a higher price after each round.

One standout feature about $TAP that whales appreciate is its deflationary mechanics. Digitap will allocate 50% of its platform profits to buy back and burn $TAP tokens and to fund staking rewards. This means that as the user base and transaction volume grow, half of the profit is allocated toward supporting the token’s value.

Bitcoin Falls Below $100K As Odds Of A December Cut Slip

Bitcoin dipped below the critical $100,000 level that has held up quite well over the past few weeks. The narrative that supported Bitcoin’s price gains for most of 2025 hinged on the Federal Reserve’s decision to lower rates in October and again in December.

The October rate cut came as expected, but Fed boss Jerome Powell downplayed the likelihood of a second cut before the end of the year. Rate cuts are typically supportive of risk-on assets, such as Bitcoin, which would explain the rotation into presale projects.

The catalyst that everyone was expecting now stands at roughly a 50% chance of happening. What used to be a near-100% certainty is now a coin toss. This forces investors to look at strong and overlooked crypto startups with low valuations.

These tokens offer near-term protection against volatility but could also be considered a top crypto to buy now, given a strong product offering and a clear path toward market share gains.

Source: Digitap

3 Reasons AVAX Holders Rotate: Growth, Hedge, Returns

Avalanche continues to hold a strong reputation as one of the more technically advanced blockchains. It boasts high transactions per second and innovative subnet architecture while metrics like total value locked remain within historical norms.

However, the excitement around AVAX as an investment has soured, with the token down more than 50% over the past year. Avalanche holders have been looking for higher-growth stories to rotate into. Investors who bought Avalanche and hoped for a big run-up are seeing faster upside elsewhere, and presales like Digitap are among the beneficiaries.

Essentially, Avalanche investors shifting to Digitap are chasing what AVAX isn’t able to offer: near-term excitement, a hedge against downside movement, and the potential for sizable returns.

Source: @Morecryptoonl

How A Live App and Visa Deal Tilt Risk-Reward to $TAP

Bitcoin will always remain the largest crypto, and many investors will stick with it even through a severe downturn. But this isn’t reflective of everyone. Money flows don’t lie: the data is clear that investors believe the crypto presale project Digitap is a top crypto to buy now.

Avalanche holders are in a similar position, although their token has been down sharply over the past year. For the frustrated Avalanche holder, Digitap represents an application-layer success story that doesn’t depend on one chain’s adoption.

In many ways, Digitap is riding the broader success of the crypto ecosystem: stablecoins, DeFi, and layer-1 improvements. Digitap is leveraging the best of what crypto has to offer and packaging it for mainstream consumption.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post Which Is the Best Crypto to Buy Now? Bitcoin and Avalanche See Shifts to Digitap ($TAP) appeared first on Live Bitcoin News.

You May Also Like

Litecoin Forms Ascending Triangle: LTC Price Target $90 Breakout

Stellar Integrates With Space and Time to Power Data-Driven Smart Contracts