Pepe Coin (PEPE) vs. Little Pepe (LILPEPE): Why LILPEPE Holds the Edge in 2025

Meme coins continue attracting attention in the crypto market, but not all are built similarly. Pepe Coin has been a familiar face for some time, while Little Pepe is quickly emerging as a stronger contender with its own innovative edge. At the time of writing, Pepe Coin’s (PEPE) price is around $0.00001210 with a market cap of $4.4 billion. Meanwhile, Little Pepe (LILPEPE) is in stage 13 of its presale, selling at $0.0022 after climbing from earlier stages where it started at $0.0010. This progression means early investors are already up 120% gains, and those entering the current stage still have about 36.36% gain potential before the official launch at $0.0030. That kind of room for growth, combined with features and community energy, is why many believe LILPEPE could surge by as much as 3,938% before the end of 2025.

Little Pepe (LILPEPE): A Rising Challenger

Little Pepe has arrived with a different pitch to investors. Built on a next-generation Layer 2 solution running on Ethereum, it offers ultra-low fees, fast transaction finality, and zero transaction tax. At the time of writing, LILPEPE is in stage 13 of its presale at $0.0022, having already raised $25,549,047 of its $28,775,000 target with 15.7 billion tokens sold out of the 17.25 billion allocated for presale. The structured presale model is already rewarding early participants. Stage one investors are sitting on gains of over 120%, and even current buyers are positioned for around 36.36% of the profits once the token lists at $0.0030. This shows that LILPEPE has created a tangible early mover advantage for its community, something many meme coins fail to provide.

Community Momentum and Market Attention

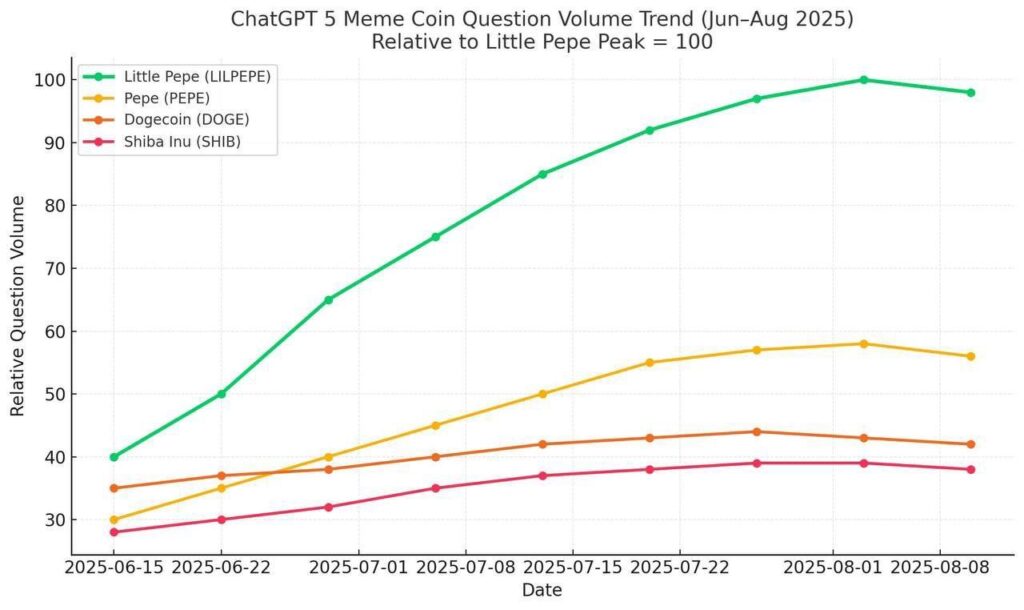

One of the most striking signals is how LILPEPE has outperformed other meme coins in online search and trend volume. Between June and August this year, LILPEPE peaked at 100 on the ChatGPT 5 memecoin question volume index, surpassing PEPE, Dogecoin, and Shiba Inu.

Adding to this momentum, LILPEPE has launched a $777,000 giveaway campaign alongside a Mega Giveaway offering over 15 ETH prizes to top presale buyers from stage 12 to stage 17. These moves strengthen community ties and incentivize active participation at a time when retail investors are searching for fresh, exciting projects.

Why LILPEPE May Hold the Edge in 2025

Comparing PEPE and LILPEPE reveals a clear difference in potential. PEPE has already achieved massive market cap growth, but now faces the uphill task of sustaining value without clear technological innovations. On the other hand, LILPEPE is still early, affordable, and technologically more agile. Its Layer 2 framework, tax-free transactions, and community-driven growth give it a better chance at delivering higher gains. This is why many investors believe LILPEPE could realistically outperform PEPE before the year ends. While PEPE may continue as a popular veteran coin, the sharpest gains often come from the younger challengers. With early backers already doubling their money and current buyers positioned for a near 36% upside before launch, LILPEPE stands as the stronger play.

Final Thoughts

At the time of writing, Pepe Coin is trading at $0.00001210. But Little Pepe, selling at $0.0022 in stage 13 of its presale, represents a fresh opportunity with a community-centric approach, faster tech, and transparent growth milestones. With early investors already up 120% and new buyers still able to secure potential 36.36% gains, it is easy to see why people call LILPEPE one of this cycle’s most promising meme coins. LILPEPE could surge by as much as 3,938% before the end of 2025. Dont miss out on the next meme coin revolution. Join the Telegram group, or read more on the official Little Pepe website.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken

You May Also Like

USD mixed ahead of key FOMC decision – Scotiabank

Risk back on the table as crypto ETFs bounce back