Solana validators face changes: the foundation intends to decentralize, and half of the validators face survival challenges

Author: Frank, PANews

As the SOL ETF is put on the agenda by institutions, the Solana ecosystem seems to be accelerating the pace of reform of decentralized governance. On April 23, the Solana Foundation launched a new policy. For each new validator in the Solana Foundation Delegation Program (SFDP), if some validators have been eligible for Solana Foundation delegation on the mainnet for at least 18 months and have staked less than 1,000 SOL outside of the Solana Foundation delegation, three of them will be removed. Behind these policies, attempts are made to improve the independence of validators by reducing their dependence on the foundation. But it seems that the final result may still be the optimization of large-scale small and medium-sized nodes.

“One in, three out” optimizes the validator structure

The most striking part of the new policy is its “one in, three out” replacement rule. Specifically, for every new validator added to the Solana Foundation Delegation Program (SFDP), three existing validators will be removed.

The eligibility criteria for triggering removal are very clear and include two key conditions. First, the validator must have been delegated by the Foundation for at least 18 months; second, the validator must have less than 1,000 SOL staked outside of the Foundation’s delegation. These two conditions combined precisely target validators that have participated in the delegation program for a long time but have failed to demonstrate their independent viability by attracting community support.

It is worth noting that this policy took effect immediately after the announcement, showing that the Solana Foundation is eager to advance the decentralization of the Solana network.

Impact may involve half of the validators

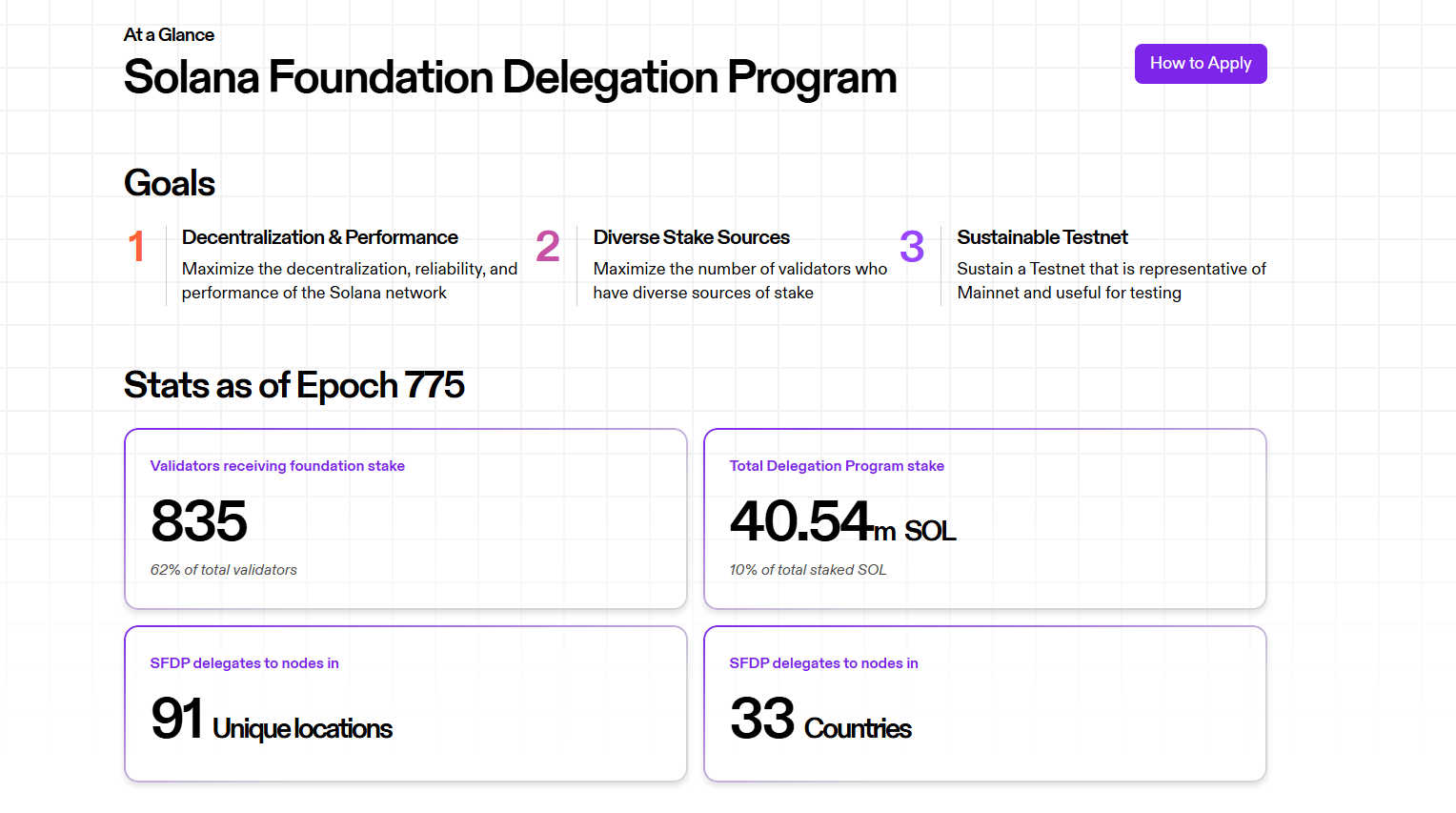

According to official data, as of April 24, 835 validators are accepting stakes from the Foundation through SFDP, accounting for 62% of the total number of validators on the Solana network. The total amount of SOL entrusted through the program is approximately 40.5 million SOL, accounting for 10% of the total amount of SOL staked on the Solana network.

According to data from a report by Helius at the end of August 2024, about 51% of validators have less than 1,000 SOL staked from outside. If this ratio does not change much, the current number of eligible validators is about 686. In the future, affected by this policy, if these validators fail to attract more SOL stakes, they may be forced to withdraw from the ranks of validators. The reason for such a large impact is that many validators rely on the Solana Foundation's SFDP plan to survive.

As for why the support of the foundation is directly related to the life and death of many validators. Let's review the SFDP plan. The Solana Foundation Delegation Program (SFDP) is one of the core mechanisms in the Solana ecosystem to support the development of the validator network. The original intention of the establishment of this plan is to guide growth in the early stages of the network and lower the entry threshold for validators, especially by providing basic delegation, so that validators with less capital can also participate in consensus and obtain rewards, thereby promoting the growth of the number of validators and the overall security of the network.

SFDP supports validators in a number of ways:

1. Stake Matching: This is the key mechanism to incentivize validators to attract external stakes. The Foundation will match the external stakes obtained by the validator at a 1:1 ratio, with a maximum matching amount of 100,000 SOL. However, this matching is not unlimited. Once the external stake of the validator exceeds 1 million SOL, the Foundation will no longer provide any delegation (including matching and remaining delegation).

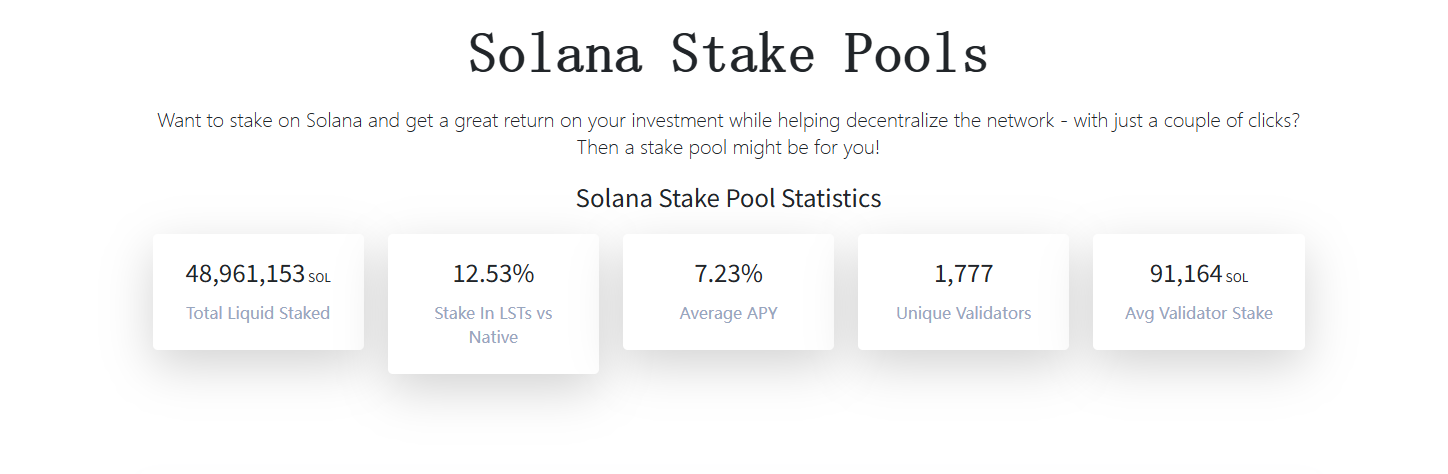

2. Residual Delegation: After all eligible staking matches are completed, the remaining SOL in the SFDP fund pool will be evenly distributed to all other eligible validators. According to Helius' analysis, this part of the delegation is currently about 30,000 SOL per validator. However, the Foundation has stated that as it increases its investment in community-operated staking pools, this part of the residual delegation is expected to gradually decrease.

3. Voting Cost Assistance: Running Solana validators requires paying continuous voting transaction fees, which is a considerable expense for new or small staked validators (about 1.1 SOL per day). In order to alleviate this initial burden, SFDP provides a time-limited voting cost subsidy program. For new mainnet validators applying for this support, the Foundation will cover 100% of the voting costs in the first 45 epochs (about 3 months) after joining the program, and then reduce the coverage ratio by 25% every 45 epochs until the subsidy stops after 180 epochs (about 1 year).

Is Solana stuck in a vicious circle of becoming more centralized as it reforms?

According to Laine’s 2024 estimate, a validator will need at least 3,500 SOL staked to balance the voting costs, not including the server cost of more than $45,000 a year. Therefore, it can be said that if forced to use the SFDP plan, a large number of small validators will have no choice but to shut down.

Fortunately, this plan has two external conditions, which are that the validators have joined the SFDP plan for 18 months and when the SFDP needs to add a new validator. This can also be regarded as a buffer period for those validators who do not meet the conditions.

From the design intention, this plan is to reduce the dependence of validators on the Solana Foundation, enhance the independence and community support of validators, and reduce the outside world's view that the Solana Foundation has excessive influence on the ecosystem. However, from the perspective of possible foreseeable results, if after the removal of validators, there are not enough new validators of sufficient quantity or quality to fill the vacancies in time, or if the new validators themselves find it difficult to survive in a highly competitive environment, then the total number of validators on the network may decrease, which will damage decentralization.

On April 22, Paul Atkins, the new chairman of the U.S. SEC, was sworn in. After the new chairman who is close to cryptocurrencies takes office, there will be 72 crypto-related ETFs waiting for approval. Although many of them may be difficult to pass, SOL, which ranks at the top as the most popular token, may be one of the tokens expected to be approved. From the timetable, the final approval date of SOL is basically concentrated in October 2025. However, the important problem Solana is currently facing is similar to the reason why Ethereum has been postponed many times before, that is, the lack of decentralization may lead to the possibility of being judged as a security. Therefore, this may be one of the main reasons why the Solana network must actively promote the degree of decentralization at present.

On the other hand, with the recognition of more and more institutions in the market, Solana's network may welcome more and more large validators in the future. On April 23, SOL Strategies, a company listed on the Canadian Stock Exchange, announced that it had obtained a convertible note financing of up to US$500 million, which will be used specifically to purchase SOL and stake it on the validator nodes operated by the company. On the same day, another US listed company, DeFi Development Corporation, announced that it would increase its total SOL position to 317,000, and planned to hold it for a long time and participate in staking to obtain income.

In the final analysis, whether it is the previously overturned SIMD-0228 proposal or the current Solana Foundation "New Deal", and the entry of more and more institutions, the final direct result seems to be that small and medium-sized validators are frustrated, and the threshold seems to be getting higher and higher. And this result itself does not seem to be helpful in promoting the degree of decentralization. For Solana, how to lower the threshold for validators may be the attitude to truly promote decentralization.

You May Also Like

Ripple CEO: Stablecoin Market Could Hit $2 Trillion in Coming Years

Crypto ATM operator Bitcoin Depot revealed that 27,000 customer information was leaked last year