Analyst: Bitcoin Peaks Follow Halving Patterns—Next One Expected by Late 2025

Crypto analyst Cryptobirb predicts that bitcoin is nearing its cycle peak, which is likely to occur between October 19 and November 20, 2025.

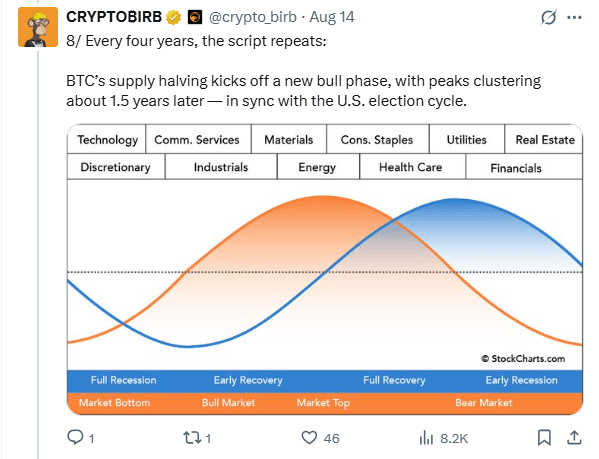

Halving Events and Bull Market Length

A crypto analyst is projecting bitcoin ( BTC) to peak between Oct. 19 and Nov. 20, 2025, before bears typically take over. Using the Bitcoin Cycle Peak Countdown model, Cryptobirb asserts the BTC bull market, which usually lasts 1,060 to 1,100 days, is now at day 997 since the cycle low observed on Nov. 21, 2022.

In an Aug. 14 post on X, Cryptobirb suggested that BTC halving events often provide clues of when the top cryptocurrency is likely to peak. As explained in the post, while BTC peaked some 366 days after the first halving event, subsequent halving events show it peaking more than some 500 days later. It has now been more than 550 days since the last halving event occurred on April 19, 2024, and according to Cryptobirb, BTC is now less than 70 days away from reaching its latest cycle peak.

Cryptobirb also points to the length of each BTC’s last four bull markets to back projections of his model. While this lasted just short of a calendar year in 2010-2011, it more than doubled to 746 days in the 2011-2013 bull market. However, since then, each of the BTC bull markets has surpassed 1,000 days, and the current one is already tracking toward 1,060-1,100 days, Cryptobirb said.

“Where are we now? Cycle low: Nov. 21, 2022 (997 days ago). Days since last halving: 482, peak odds also highest in next 3 months, with the sweet spot between Oct. 15 & Nov. 15, 2025,” Cryptobirb concluded.

According to the crypto analyst, bear markets also follow a pattern; each typically lasts between 370 and 410 days. The average loss incurred in each bear market, which Cryptobirb projects to take hold in 2026, has been -66%.

Although BTC has been setting milestone after milestone since the start of the year, Cryptobirb’s model asserts that October and November are bitcoin’s “best months” because they “deliver the top average gains and the most all-time-highs.”

To prepare for this, Cryptobirb urged his followers to plan their exit, cut leverage and take profits while readying for an altcoin season which starts post-peak

You May Also Like

Trump’s Crypto Gains Risk Backlash Post-Presidency, Ethereum Veteran Advises Urgency

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise