Crypto infrastructure that drives both technology and applications, how does Quai Network open up the PayFi highway?

Author: Nancy, PANews

Crypto assets are accelerating their penetration into the real world. As a new financial paradigm that integrates traditional payments and DeFi, PayFi can free payment flows from the lengthy paths of financial institutions and reshape the way of financial interaction in the real world. In response to this market trend, L1 blockchain Quai Network, which officially launched its mainnet not long ago, has created a crypto infrastructure driven by both technology and applications, which can help unlock more potential for PayFi. Its innovative design can break the efficiency bottleneck of traditional payments and the scalability problem of blockchain, thus paving the way for seamless connection between the crypto economy and the real world.

Challenging the “Impossible Triangle” and paving a technological highway for PayFi

Bitcoin has evolved from a niche consensus among geeks to a global mainstream asset, marking the gradual maturity of crypto technology and its integration into traditional finance. As an emerging crypto narrative, PayFi challenges the traditional financial framework with the innovative model of "Buy Now Pay Never". It should be noted that the traditional payment system is limited by high fees, long settlement cycles and geographical restrictions, while the existing crypto payment solutions face problems such as cost fluctuations, insufficient throughput and narrow application scenarios, making it difficult to meet large-scale commercial needs.

PayFi aims to achieve instant settlement, low-cost cross-border payment and seamless linkage with RWA through blockchain, solve the pain points of traditional finance and give practical value to crypto assets. However, its large-scale application needs to find a balance between transaction efficiency, cost control and ecological compatibility, which places extremely high demands on infrastructure. As a scalable and programmable L1 blockchain, Quai Network provides support for PayFi with its technological advantages.

PoEM and Dynamic Sharding: Quai Network combines the innovative consensus mechanism PoEM with dynamic sharding architecture to provide an efficient, scalable and secure blockchain solution.

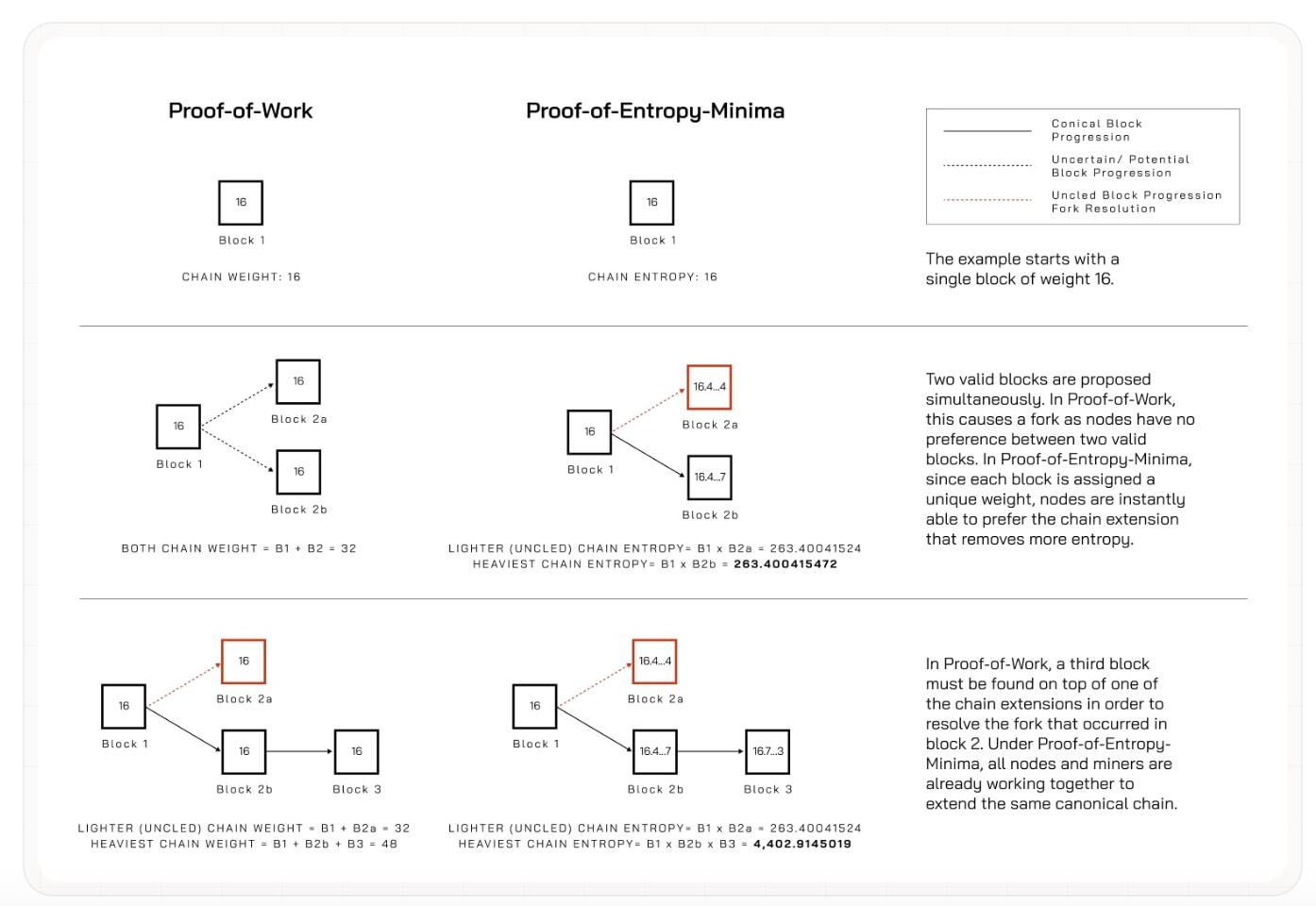

Specifically, Quai Network's sharding architecture uses a dynamic sharding algorithm that can process transactions in parallel based on transaction needs, increasing throughput without sacrificing security. Unlike the single-chain recording method of traditional blockchains (such as Bitcoin or Ethereum), Quai Network processes transactions concurrently through multiple independently executed shards to achieve higher performance. However, as the number of shards increases, cross-shard coordination and consensus speed become expansion bottlenecks. PoEM optimizes PoW consensus and introduces entropy (i.e. randomness) removed from blocks to give block weights. Nodes prioritize blocks with the most entropy removed as chain heads, thereby eliminating fork disputes, quickly reaching consensus, and reducing the impact of network delays.

It can also be understood that dynamic sharding is a multi-lane highway, which can dynamically adjust lanes according to transaction volume, allowing transactions to be processed in parallel to avoid congestion; PoEM is like an intelligent navigation system, giving priority to "least troublesome" transactions to pass first, ensuring smooth cross-shard transactions without conflicts. This allows Quai Network to maintain high throughput and security in high-load scenarios, becoming a super highway designed for future payments.

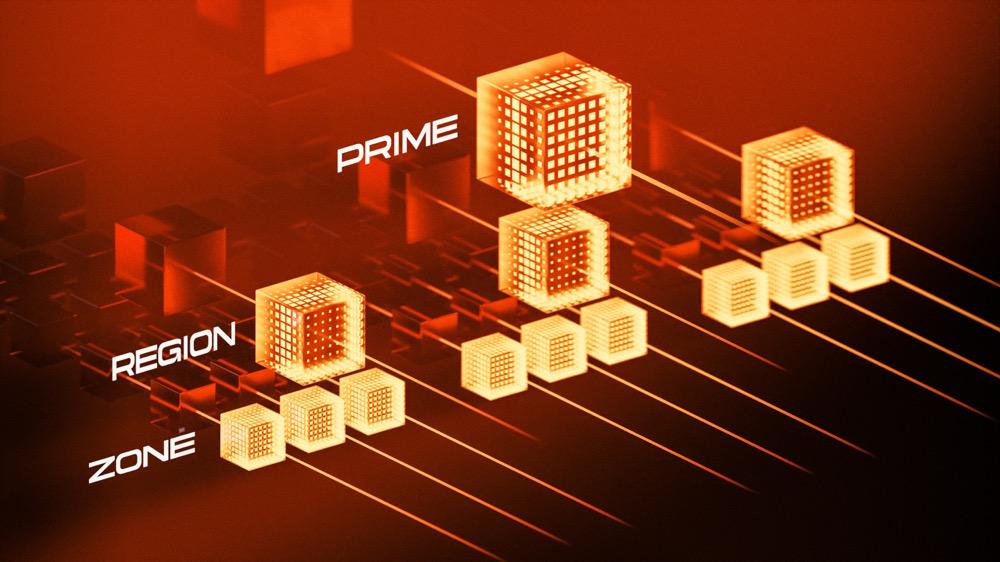

· Cross-chain interoperability: Quai Network adopts a hierarchical multi-chain architecture, dividing the network into multiple interoperable blockchains (execution shards): Prime Chain, Region Chains, and Zone Chains. This design can achieve a throughput of up to 50,000 TPS. To improve the efficiency of cross-shard transactions, Quai Network integrates seamless cross-chain transactions (ETXs), multi-chain contracts, atomicity guarantees, and dynamic sharding to ensure efficient and secure interoperability.

Imagine that using Quai Network to transfer money is like swiping a universal credit card. Whether you are sending money from the United States to a friend in Europe or buying a cup of coffee on the street corner, the money will arrive in a few seconds, the fee is less than 1 cent, and it is safe and tamper-proof. In this process, the main chain is responsible for coordination, the sub-chain is responsible for clearing the bill, and the partition chain is like a cash register that settles instantly, making cross-border payments as fast and efficient as local transactions.

More importantly, Quai Network is compatible with the Ethereum Virtual Machine (EVM). Developers can directly use Ethereum tools to develop and deploy smart contracts without having to learn a new technology stack, which greatly reduces the entry barrier. At the same time, Quai Network can also seamlessly connect with the Ethereum ecosystem (such as DApps, wallets, and infrastructure). In addition, Quai Network also adopts an anti-MEV (maximum extractable value) transaction sorting mechanism to ensure fairer and more efficient execution in the DeFi market.

Merged Mining: Quai Network significantly improves the scalability, security, and energy efficiency of blockchains through a merged mining mechanism. Miners can hash and protect multiple blockchains at the same time. This concept was first proposed by Satoshi Nakamoto, and Quai Network has further developed it into a multi-chain shared protocol network, which ensures network security and efficient collaboration through multi-chain parallelism, shared computing power, and overlapping blocks. In the Quai Network system, miners can mine three chains at the same time, improving computing power utilization and network throughput. Overlapping blocks (generated when miners find a nonce that meets the multi-chain difficulty) realize cross-chain state transfer through hash links, reducing reliance on trust and enhancing system stability.

For example, Xiao Pai buys coffee at a global coffee chain. Traditional blockchain is like using independent cash registers in stores in each country, which makes checkout slow and error-prone. However, Quai's merged mining is like an accountant using smart devices to process bills from multiple stores at the same time, making payment fast and secure. The overlapping block is a payment voucher that can be used in multiple countries. No matter which chain is used for payment, the system can quickly identify and complete the settlement.

In addition, Quai Network adopts the ASIC-resistant ProgPoW algorithm to encourage GPU mining, lower the hardware threshold, and strengthen decentralization. Of course, any blockchain that supports ProgPoW can join Quai Network for merged mining to further expand the ecological influence.

From this point of view, as the global demand for high-performance blockchain continues to grow, Quai Network attempts to break the "impossible triangle" problem through technical innovations such as PoEM consensus, dynamic sharding, cross-chain interoperability and merged mining, and builds an efficient, secure and scalable blockchain network. It can inject more possibilities into high-load application scenarios such as PayFi, and lay a technical foundation for the popularization of encrypted assets.

Create a dual-wheel driven token model, the mainnet has been officially launched

In addition to providing strong technical support for PayFi's diverse application scenarios, Quai Network's dual-token economic model can balance stability and flexibility in different financial market environments, bringing a dual-wheel drive of value storage and transaction medium to PayFi's application scenarios.

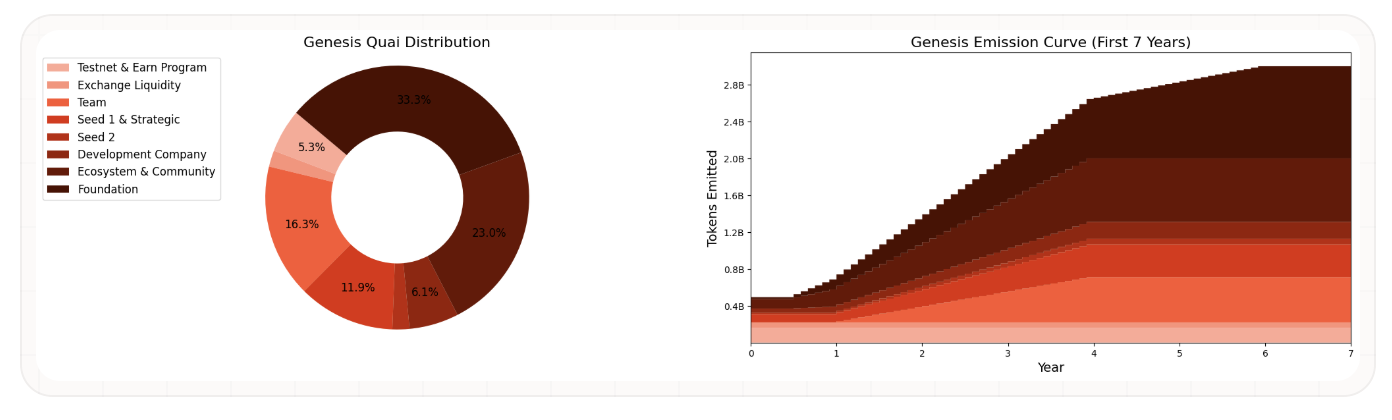

Among them, Quai is an EVM-compatible deflationary token that performs the function of storing value. The supply of Quai consists of two parts: the pre-allocation of the genesis block and the miner reward. It is designed with scarcity and deflation mechanisms to ensure that the growth rate of token supply is always lower than the network expansion rate. In other words, as the network scale and participation increase, the supply of Quai will gradually decrease. This mechanism effectively avoids the cyclical boom and bust model in the traditional economy, allowing Quai to not only meet the decentralized economy's demand for value storage, but also maintain the potential for value-added in the long run. In the PayFi scenario, Quai's value storage function provides users and financial institutions with a stable asset anchor point, such as savings products, DeFi collateral or settlement assets, cross-border asset management, and many other practical applications.

Qi is another core token in Quai Network. As an energy-backed "flatcoin", its value is directly linked to the energy cost consumed by mining. This allows the supply of Qi to flexibly respond to changes in market demand and mining costs: when mining difficulty increases, Qi supply increases; when difficulty decreases, supply decreases accordingly. Quai Network has also designed a two-way conversion mechanism between Qi and Quai, which users and miners can exchange according to the current block reward ratio.

Qi also has cash-like privacy characteristics and low volatility, and can be used as a unit of account and medium of exchange, suitable for daily payments and dynamic financial activities. Its efficiency and stability provide support for PayFiPayFi's daily payments and dynamic financial activities, including instant payments, incentives for ecological participation, etc., allowing users to enjoy the convenience of blockchain in daily transactions while avoiding drastic price fluctuations.

It can be said that Quai Network's dual-token model provides PayFi with dual guarantees of stability and flexibility in different market environments. It can not only meet the diversified financial needs of wealth preservation and efficient payment, but also lay a solid foundation for the diversified application scenarios of decentralized finance.

The innovation of Quai Network has also been recognized by capital and the market. So far, Quai Network has received $15 million through multiple rounds of financing, with participating institutions including Polychain, Alumni Ventures, MH Ventures, Cogitent Ventures and TPC Ventures. At the same time, Quai Network actively builds and expands its cooperation ecosystem, covering DeFi, AI, DAO, infrastructure, wallets and other fields, including Kaito AI, IO.NET, Entangle, Akash Network, MarginEx, IceCream Swap, Penomo, Portal DeFi, Butterfly Protocol and UTXO Alliance.

In general, Quai Network has built a high-speed road for the crypto economy and business scenarios, which is a combination of technology and applications, and especially provides an ideal infrastructure for high-load, low-latency payment applications such as PayFi. Through technological innovations that challenge the "impossible triangle" and dual-wheel-driven token design, Quai Network not only helps to resolve the contradiction between traditional payments and blockchain scalability, but also accelerates the deep integration of crypto assets with the real world, bringing more room for the decentralized economy.

You May Also Like

The Rise of SASE: Engineering the Future of Cloud-Delivered Security

Tether invests $81.6M in Italian Humanoid-Robotics firm as AI push accelerates